There are many reasons you might choose to buy tax notebook but it is not easy to find the best suitable tax notebook for you. But don’t worry! We did some of the work for you already by researching a few models on the current market. Let’s check following article to find the best tax notebook.

Rank

Product Name

Score

Related posts:

Best tax notebook reviews

1. BookFactory Income & Expense Journal/Income and Expense Ledger Book/Accounting Bookkeeping Tracking Ledger Log Book/LogBook 108 Pages - 8.5" x 11" Wire-O (LOG-108-7CW-PP-(IncomeExpense)-BX)

Feature

Income & Expense Log Book - Record Income and Expenses by Day, Week, and MonthWire-O book with color cover and TransLux cover for protection with the Title "INCOME & EXPENSE"

Book lies flat when open, Page Dimensions: 8 1/2" x 11", acid-free, 60 lb. paper

BookFactory is a Veteran-Owned Firm. Made in USA. We Proudly Produce Our Books in Ohio, USA.

2. Small Business Expense and Inventory Tracker: Record Sales, Income, Suppliers, Mileage, and more!

3. Simple Ledger: Cash Book | 110 pages | DIN A5 | Simple Income Expense Book | Black Leather Look | Durable Softcover

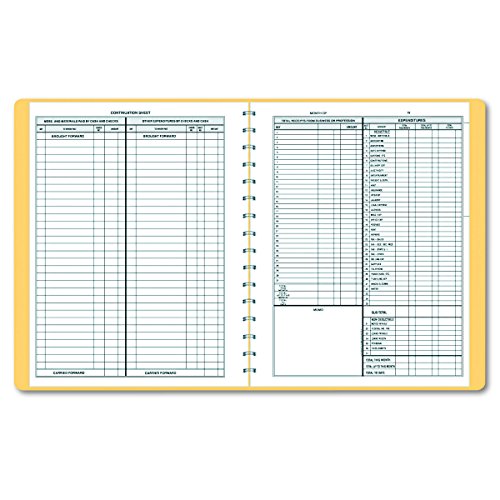

4. Dome 612 Bookkeeping Record, Tan Vinyl Cover, 128 Pages, 8 1/2 x 11 Pages

Feature

Record book offers a simple way to keep accurate records of Cash Received and Paid Out.Wirebound record book with Lexhide cover is undated and good for a full year.

Book contains 128 pages. Non-refillable. Design includes a payroll section for up to six employees, calendar of tax forms, detachable summary sheet, completed specimen page, list of 276 deductions allowed by law and other exclusive features.

Bookkeeping Records. Record of Cash Received and Paid Out. Includes Net Profit, Net Worth, Payroll.

Record of Cash Received and Paid Out.

Includes Net Profit, Net Worth, Payroll.

Undated - start anytime.

It has 128 pages, wirebound.

5. Adams Bookkeeping Record Book, Monthly Format, 8.5 x 11 Inches, White (AFR71)

Feature

Allows you to track all aspects of your businessTrack expenditures from payroll to revenue and income

Monthly version

Non-dated format allows you to start any time of the year

8.5 x 11 inches

6. Adams Bookkeeping Record Book, Weekly Format, 8.5 x 11 Inches, White (AFR70)

Feature

Allows you to track all aspects of your businessTrack expenditures from payroll to revenue and income

Weekly version

Non-dated format allows you to start any time of the year

8.5 x 11 inches

7. DOM912 - Tax Deduction File, w/Pockets, 11x9-3/4

Feature

Sold Individually8. BookFactory Mileage Log Book/Auto Mileage Expense Record Notebook for Taxes - 126 Pages - 5" X 7" Wire-O (LOG-126-57CW-A(Mileage))

Feature

This record book has space for 354 car tripsThere are pages to log your annual mileage summary as well as your annual expense summary

Durable Translucent Cover, Side Bound Wire-O Binding

Archival safe, acid-free, 60 lb. paper, Page Dimensions: 5" x 7"

BookFactory is a Veteran-Owned Firm. Made in USA. We Proudly Produce Our Books in Ohio, USA.

9. BookFactory Business Expense Journal/Expense Ledger Book/LogBook 110 Pages 8.5" x 11" Wire-O (BUS-110-7CW(BusinessExpense)-BX)

Feature

This is a great book for small businesses to use to track expenses by day, week, and month.There are spaces to track automobile, meals, travel, and other misc. expenses - like car rental, lodging, gas, office supplies and other business expenses.

110 Page Business Expense Journal 8.5" x 11"

Printed Full Color Business Expense Cover with Translux for Protection

BookFactory is a Veteran-Owned Firm. Made in USA. We Proudly Produce Our Books in Ohio, USA.

10. Tax Deduction Logbook: Tax Write offs Ledger for Small Businesses - Perfect for Freelancers, Local Shops, Resellers, Independent Contractors, Direct ... Businesses to Track Deductible Expenses